Home » Enterprise 5G Services Need a Modern, Digital BSS

Our guide to the 2021 telecoms.com Annual Industry Survey results

The best way to get under the skin of the telecoms world is to ask industry professionals their opinion, so we collaborated with telecoms.com on their 2021 Annual Industry Survey.

A clear message from the 280+ respondents is that increasing numbers of CSPs are turning their attention to the enterprise market to combat the declining profit margins associated with consumer services. 5G is a key driver for this move as it will enable new business services in a range of verticals, bringing new opportunities to increase revenues and market share. However, success in these verticals will remain out of reach for CSPs with outdated and inflexible business support systems (BSS) that are unable to do the heavy lifting needed to support enterprise business needs.

Read on to learn our key takeaways from the survey, or download our full insights report.

Key takeaways from the survey results

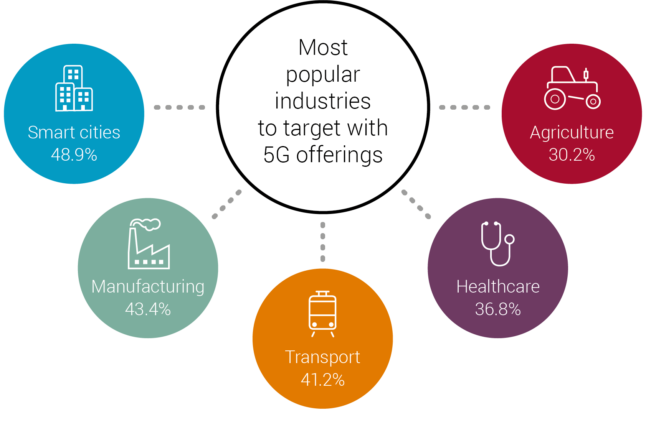

Most popular industries to target with 5G offerings

CSPs have ambitious plans for targeting the enterprise market with new 5G offerings, with the most popular verticals being:

- Smart cities – 48.9%

- Manufacturing – 43.4%

- Transport – 41.2%

- Healthcare – 36.8%

- Agriculture – 30.2%

Whilst smart cities take first place, there is little difference in the relative popularity of these verticals, suggesting that CSPs have yet to identify exactly where they should focus their efforts.

Third party partnerships will create new revenue streams

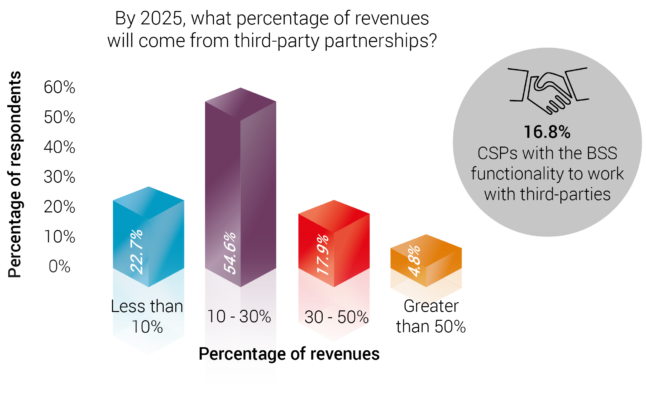

Few CSPs will be experienced in the new verticals they plan to enter, so they will need to partner with third parties to create solutions that will appeal to businesses within that sector. 54.6% of respondents believe that by 2025, between 10% and 30% of operator revenues will come from these third-party partnerships, with a further 17.9% believing the figure will be as high as 30% to 50%.

However, CSPs can only build these new relationships and services if their BSS has the necessary functionality and agility, which is only the case for 16.8% of respondents.

Read our whitepaper on The 5G Flexibility and Creativity Driving BSS Modernisation to understand how 5G will enable service providers and business curators to work together to co-create new enterprise services.

5G expectations VS reality

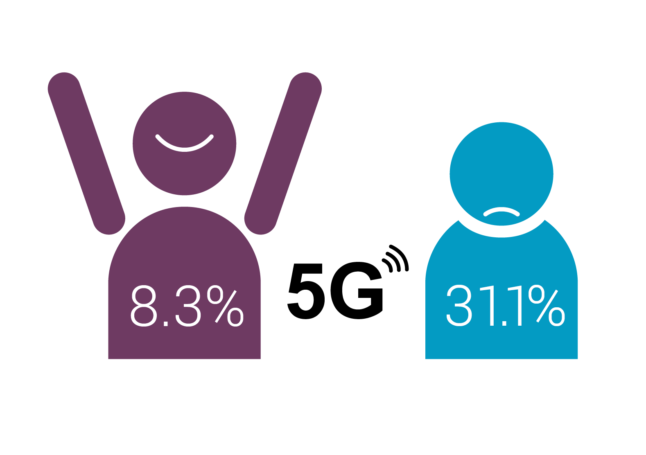

Two and a half years into its commercial service, 5G has exceeded the expectations of 8.3% of respondents. It has disappointed 31.1%.

Service providers that are undecided on their investment focus and have yet to identify appropriate partnerships will be unable to realise the full value of their 5G networks.

Read our report, Enterprise 5G: The Role of the Telco, to understand how CSPs are positioning 5G services in the B2B market.

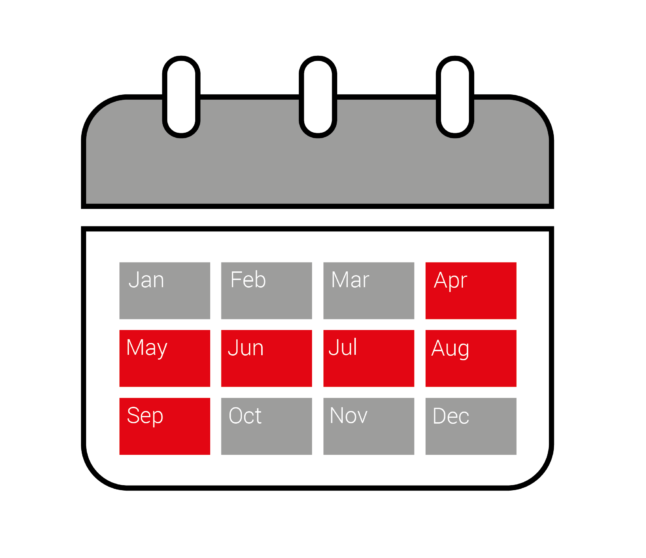

Time to market for new services

When launching any new service, time is of the essence. To succeed in the enterprise world, CSPs must get their new offerings to market quickly, before the window of revenue opportunity closes or a competitor gets in there first. For 29.2% of CSPs, it takes more than six months to launch a new service, making it difficult for them to be the first to market with competitive new offers.

MDS Global’s Metro deployment uses convention over configuration to enable service providers to launch new services in as little as twelve weeks.

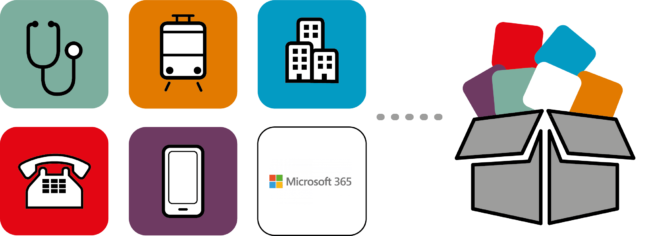

Bundling together new and existing services

New enterprise offerings will bundle together traditional telco services, such as fixed line and mobile, with a range of new telco and non-telco services, such as hardware, software licences, hosting and security. However, a third (33.6%) of CSPs currently find it very difficult or altogether impossible to bundle together new and traditional telco services.

Read our blog post to understand why service bundling is essential for CSPs entering the enterprise market, and our other must-have BSS capabilities for 2022.

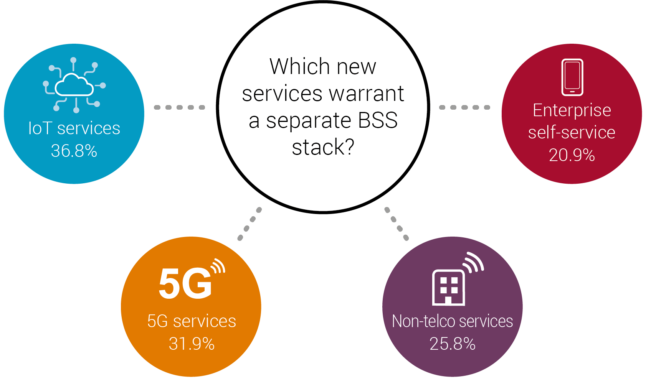

Which enterprise services warrant a separate BSS stack?

The reason why service providers find it difficult to work with partners, bundle together new services and get them to market quickly is because traditional BSS stacks were not designed to handle the complexity of the enterprise market. Many CSPs are therefore planning to use a separate stack for their new enterprise services, but which services do respondents believe warrant a separate BSS stack?

- IoT services – 36.8%

- 5G services – 31.9%

- Non-telco services – 25.8%

- Enterprise self-service – 20.9%

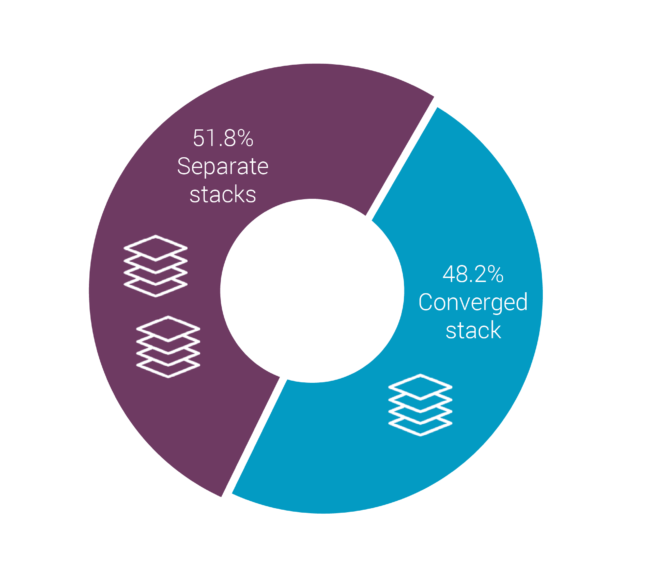

Separate or converged?

Right now, however, almost half of CSPs (48.2%) use a converged stack for consumer and enterprise customers. For CSPs providing basic B2B services that are similar to their consumer offerings, this approach may work well, but as their enterprise offerings become more complex, they will need a dedicated BSS stack designed to meet the requirements of the enterprise world.